SEMI pointed out that with the increased demand for information center infrastructure and server storage, coupled with the new crown outbreak and the deepening sino-US trade war, the reserve of safety stocks in the supply chain is the main factor driving this year's sharp increase in wafer plant equipment spending. Before ushering in this wave of overall wafer plant equipment investment upward trend, the semiconductor industry has only experienced a 9% decline in wafer spending in 2019, in the recovery phase of the first and third quarters of 2020 real and projected expenditure both fell, but the second and fourth quarters of the rise, showing a wave-like ups and downs.

By chip category, storage-related investment grew the most by $3.7 billion in 2020, up 16% from the same period last year, with total spending rising to $26.4 billion and by 18% to $31.2 billion in 2021; The rally will slow in 2021, but is still estimated at 7%. DRAM expects to slow in the second half of 2020, rising 39% the year after growing 4%.

Other semiconductor equipment spending projections:

1. Wafer construction, the second largest category of equipment spending in 2020, will increase by $2.5 billion in 2020, up 12% year-on-year to $23.2 billion, and slightly increase by 2% to $23.5 billion in 2021.

2. Microprocessor (MPU) equipment spending will fall by $1.2 billion, or 18%, in 2020 and grow 9% to $6 billion in 2021.

3. Analog expenditure will grow by a strong 48% in 2020 and to 6% in 2021;

4. Expenditure on image sensor equipment is expected to grow by 4 per cent to $3 billion in 2020 and by 11 per cent to $3.4 billion in 2021.

SEMI Global Fab Forecast covers more than 1,300 fabs and production lines, including fab and plant construction investment capacity and technology. The report shows plans for 21 new plants starting in 2020, from research and development plants to mass production plants, as well as projects with high and low construction possibilities. The new plan Chinese mainland (9) and 5 in Taiwan. 2 in South-East Asia and the Americas; The report also tracks plans for 18 new plants planned for next year - 10 in Chinese mainland, 3 in Taiwan, 4 in the Americas and 1 in Europe/Middle East.

Q2 Global semiconductor equipment shipments up 26% year-on-year

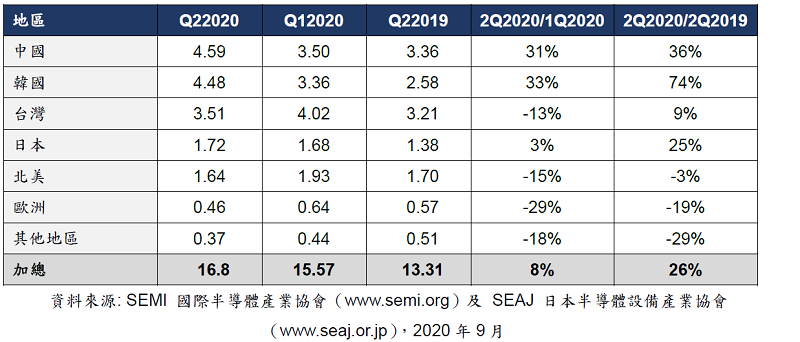

At the same time, SEMI also released its latest Global Semiconductor Equipment Market Report (WWSEMS), noting that global shipments of semiconductor manufacturing equipment surged 26% year-on-year to $16.8 billion in the second quarter of 2020, an 8% increase from the first quarter.

The above report aggregates information submitted by more than 80 global equipment companies each month on behalf of SEMI and SEAJ Japan Semiconductor Equipment Association, an industry association that represents the global electronics design and manufacturing supply chain. Quarterly shipments by region (in US$1 billion) and quarterly and year-on-year changes by region are as follows: